The Gulf Cooperation Council (GCC) is set for a major milestone next year, as states in the GCC start to introduce VAT. But how will it affect your business and how can you quickly become compliant?

The Kingdom of Saudi Arabia and UAE will be the first 2 member countries of GCC to implement VAT. The other member countries such as Bahrain, Oman, Qatar and Kuwait are expected to implement VAT in the middle of 2018 or beginning of 2019.

VAT is a flat consumption-based tax that makes enforcing compliance straightforward. Over 120 countries worldwide use some version of VAT and it makes up 20 percent of worldwide tax revenues.

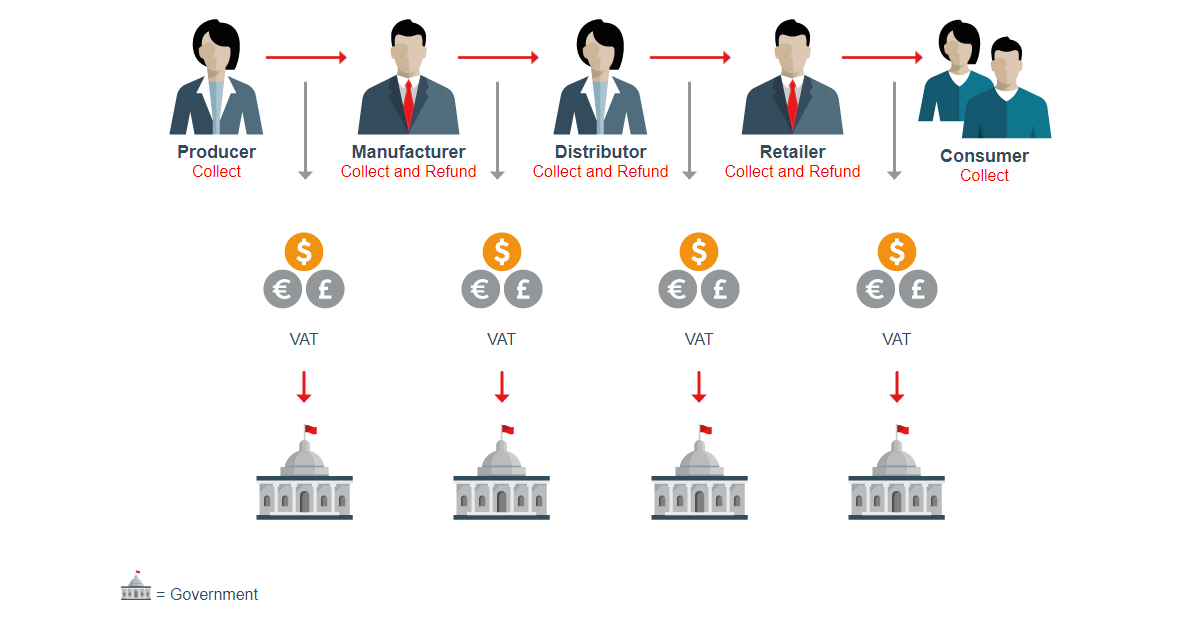

VAT is collected at every stage along the supply chain. This is certainly more complex than a simple sales tax, but it has significant advantages. One of them is that, since each buyer along the supply chain has to pay tax to the seller, and, in turn, adds tax to the invoice they send to the next buyer down the chain, there is always a counterparty that has a stake in getting reimbursed for the tax they have paid, and thus that documentation is correct. This significantly eases enforcement.

The standard VAT in the GCC will initially be 5 percent. Some categories, such as basic food and medicine, as well as exports outside the GCC, will be taxed at zero percent. In other sectors, such as education, healthcare, real estate and local transportation, details of VAT implementation may vary from one state to another.

PLUMCOT IT have helped hundreds of Companies worldwide to comply with local VAT requirements. Our product taking the opportunity to completely digitize and modernize businesses by deploying enterprise resource planning (ERP) in On-Premises.

If you have an existing business in UAE or KSA, you need to use an accounting software that can handle the UAE or KSA VAT structure so that your business is ready for VAT before 31st Dec 2017. PLUMCOT is your perfect business management solution and VAT compliance software for businesses in UAE and KSA. PLUMCOT offers comprehensive business functionalities such as Accounting, Finance, Inventory, Sales, Purchase, Point of Sales, Manufacturing, Services, Payroll and Branch Management along with compliance capabilities for VAT.

Quick tax implementations that can be completed in minutes

User can manage and modify Tax Schedules and slab rates

PLUMCOT offers the proper financial Documents and report as per the Tax department.

User can easily generate Tax reports and return statement

Easily create customized dashboards and automated reports online without technical knowledge

Monitor all relevant business information in just one place

Access all your key metrics anytime and anywhere